states recognize the church as a legal entity by extending recognition to its ministers. Historically, the IRS has ruled in some years, but not in others, that the church and various splinter groups formed from it were tax exempt, depending on issues such as the filing of annual statements. Lewis wrote that the IRS had "always suspected the ULC of being nothing but a tax dodge", noting that the IRS once ruled "that ULC congregations could not receive tax-exempt status because they had no formal beliefs", a determination that was overturned by a federal court ruling that "First Amendment forbade any branch of the government to tell any church whether it must have beliefs or not". The various lawsuits were settled in 2000 with the church paying $1.5 million in back taxes.

In 1997, the United States Court of Appeals for the Ninth Circuit also upheld the revocation of § 501(c)(3) status by the IRS against a procedural challenge regarding the timing of this revocation. § 501(c)(3) it gave tax advice to its ministers and failed to control the non-exempt activities of its congregations. The Court of Federal Claims upheld the revocation on the ground that the Church had not been operated solely for tax-exempt purposes as required by I.R.C.

The Church brought a declaratory judgment action in the United States Court of Federal Claims with respect to its tax-exempt status for the years covered. The following year, in the United States, the IRS again revoked the Church's tax exempt status. Ī 1983 ruling of the Australian High Court that a religion need not have a belief in God to be recognized was characterized as opening the door for the Universal Life Church, among others, to operate in that Australia. The district court found that the contested activities (ordination of ministers, granting of church charters, and issuance of honorary doctorates) were not a substantial enough part of the Church's activities to justify denying the exemption. The United States of America, with Judge James F. After paying the taxes and interest due for fiscal year ending April 30, 1969, the Church brought a suit for refund and prevailed in the case of Universal Life Church v.

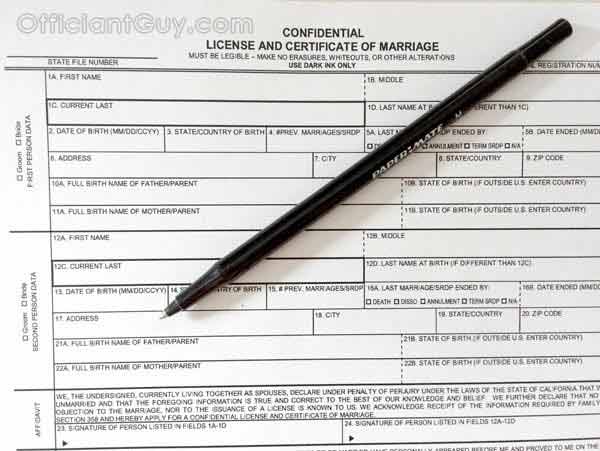

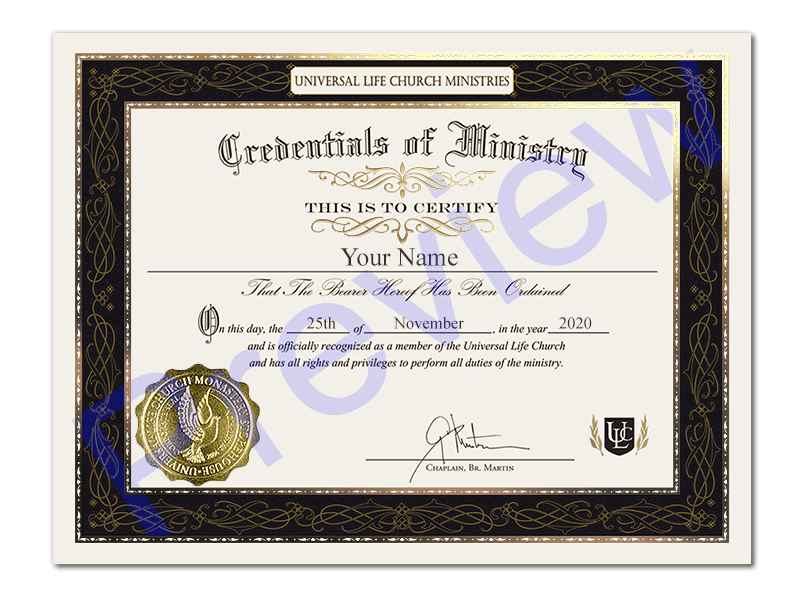

#Ministers licence california code

The IRS denied the Church's application for tax exempt status in 1969 and again in 1970 on the ground that the Church had engaged in activities outside the religious activities contemplated by the Internal Revenue Code provisions for § 501(c)(3) charitable organizations. The Internal Revenue Service (IRS) sued in the 1970s, arguing the ULC was not considered a religious group. The United States military chaplain's handbook lists ULC as a recognized church. " All subsequent cases have ruled in favor of Universal Life Church as a legal and valid church establishment. would impinge on the guarantees of the First Amendment. United States of America, the United States District Court for the Eastern District of California ruled that the Court would not "praise or condemn a religion, however excellent or fanatical or preposterous it may seem," as "to do so. In the 1964 case of Universal Life Church Inc.

0 kommentar(er)

0 kommentar(er)